Subscribe to our Newsletter!

Get exclusive updates on Discounts, Coupons, New Products, Vegan Recipes, Articles, and more…

Sell Confidently with Seller protection. You are fully protected from false buyer claims.

Get 100% on-boarding assistance for the first 3 months. All you will be left to do is to just pack and handover the product to our delivery partner and get paid instantly upon delivery.

Post Articles about your products and use them to effectively promote and market your products.

No charges for Registration or Listing. No Subscription or Recurring charges. No Hidden charges. Pay only for successful sale.

(Revised Fee Structure Applicable from 1-Jan-2024)

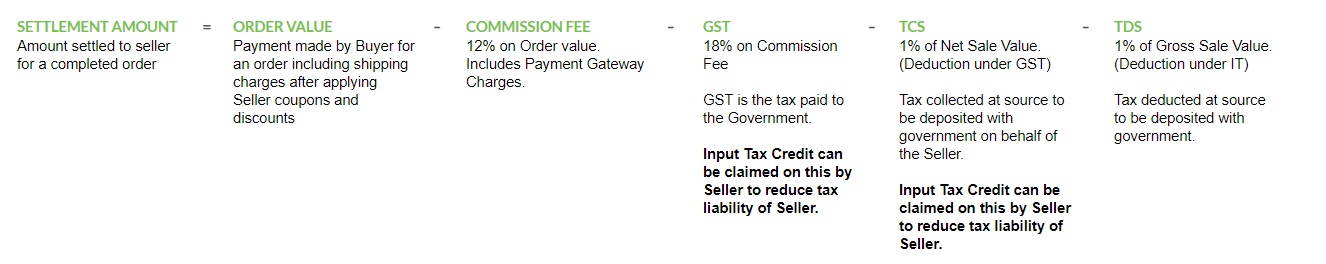

Formula:

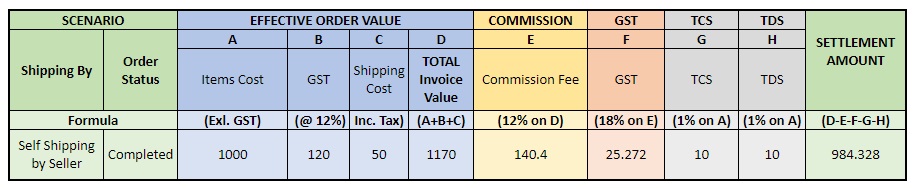

Sample FEe Calculation:

For a sample order with total items value = Rs. 1000, GST = Rs. 120 (12%), Shipping Cost = Rs. 50

If a buyer claims refund for a product you sold on VeganMall, you can defend your claim with records: photos, receipts, shipping tracking, etc. VeganMall will review your response to buyers claim and can reimburse you the full cost of the product plus shipping costs when you had followed all procedures and are not at fault.

Humble Request from VeganMall to Sellers/Suppliers: Being an exclusively Vegan Marketplace, VeganMall requests you to be sensitive to Buyers trust and confidence on your brand and ours. We believe you will take utmost care to ensure the product that you list is 100% Vegan. In case you happen to list a product that is not 100% Vegan, we will find it out during our regular audits or our Buyers will intimate us, in which cases the product will be deleted from VeganMall and you will be intimated. Since this will create a bad impression on your brand and ours, we will have to take strict actions including suspending or blocking your account if this continues to happen for three products. We also request you to ensure the description of the products on VeganMall matches exactly with the product that you ship to buyers and they are new, original, undamaged and authentic. Please also retain sufficient photographic proofs of products shipped and shipping labels.

On our journey to improve Customer satisfaction, every seller on VeganMall is required to complete the mandatory seller store self validation of important settings that impact Customer experience.

Every Seller on VeganMall is required to perform this validation at least once in 6 months. Stores not completing Self Validation at least once in 6 months will be DISABLED. Stores not completing Self Validation for more than 9 months will be DELETED.

Steps to Validate your Store:

Useful Links:

In case the below FAQ sections do not answer your questions, please reach out to us using our contact form

Yes.

As per Section 24(ix) of the CGST Act, 2017, every person supplying goods through an ecommerce operator shall be mandatorily required to register irrespective of the value of supply made by him.

References:

No. GST Composition scheme is not applicable for E-commerce sellers engaged in supply of goods through an Electronic Commerce Operator (ECO) who is required to collect Tax at source under section 52 of the CGST Act.

References:

You can directly register online here or take help of agents/online service providers who can help you on service charge basis.

GST Registration is free of cost. You can get registered under GST without paying any Government Fee. However, in some cases you have to digitally sign the GST application and there will be cost associated to obtain Digital Signature.

References:

Yes, if you are selling Food products.

Every FBO(Food Business Operator) must have a FSSAI License irrespective of their turnover to sell food online through E-Commerce and have FSSAI Logo with License Number displayed on the product.

FSSAI Logo with License Number:

References:

You can directly apply online at https://foodlicensing.fssai.gov.in/index.aspx by paying the required fee or take help of agent/online service providers to get it done for a service charge.

References:

No, but it is good for your brand to get “AYUSH Premium Mark” (International) or “AYUSH Standard Mark” (Domestic) for your products to gain customer trust and confidence.

There is no requirement of drug license or any other license for selling of Ayurvedic and herbal products. For selling Ayurvedic medicines online, a person requires only GST number. Ayurvedic medicines manufacturing is only regulated under Drug and Cosmetic Act & Rules. License is required only for manufacturing of Ayurvedic medicines. But for sell, stock or exhibit or offer for sale, or distribution of Ayurvedic medicines don’t require any license. GST is required only for trading purpose. Before selling any company products, you should take NOC from company so you don’t have to face any legal complications later.

AYUSH Premium Mark & AYUSH Standard Mark:

References:

No, but it is good for your brand to get Endorsement from FSSAI and use “Jaivik Bharat” Logo (FSSAI endorsed) along with “India Organic” Logo (NPOP certified) or “PGS-India Organic” Logo (PGS-India certified) to gain customer trust and confidence.

The Food Safety and Standards Authority of India (FSSAI License) has made mandatory to label the organic products. FSSAI issues many rules and regulations that should be followed by the food companies that are selling organic products. Companies can get a voluntary endorsement certificate with “Jaivik Bharat” logo from FSSAI who are dealing in organic produce such that the product is organic. Endorsement by FSSAI can be requested for the products once the the organic food business gets certification by “National Programme for Organic Production (NPOP)” or by “The Participatory Guarantee System for India (PGS-India)”

Jaivik Bharat, India Organic & PSG-India Organic Logo’s:

References:

No, but it is good for your brand to get Endorsement from FSSAI and use “+F” Logo (FSSAI endorsed) to gain customer trust and confidence.

+F Logo:

References:

No. You can only sell/supply goods on VeganMall

You can list any kind of products provided they are Vegan.

Ensure that there are NO animal ingredients or by-products used in the actual product or in its manufacturing process(clarification or finishing).

Ensure that NO animals are used, exploited or harmed in the manufacturing process of the product (Eg. Honey is made by exploiting Honey Bees).

Ensure that NO Animal Testing happened on the finished product or on its ingredients by supplier, producer, manufacturer or independent party

Ensure that NO Animal-derived GMOs or genes are used to manufacture ingredients or finished products.

To give you more clarity, the product should not contain any of the below;

Get in touch with us and we will help you out.

Being an exclusively Vegan Marketplace, We request you to be sensitive to Buyers trust and confidence on your brand and ours. We believe you will take utmost care to ensure the product that you list is Vegan. In case you happen to list a product that is not Vegan, we will find it out during our regular audits or our Buyers will intimate us in which cases the product will be deleted from VeganMall and you will be intimated. Since this will create a bad impression on your brand and ours, we will have to take strict actions including suspending or blocking your account if this continues to happen for three products.

Absolutely Yes. Get your product approved by PETA India. It is simple and free or charge and will add credibility and Buyer’s trust and confidence on the product. Just got here and get the ‘PETA-Approved Vegan’ Logo for your product.

‘PETA-Approved Vegan’ Logo:

As the Seller of the product, you will be deciding the price of the product.

No, there are no charges for listing a product on VeganMall and any number of products can be listed and showcased. Marketplace Fee is charged only on sale.

Detailed Description of the product, Product Ingredient details, Good quality photographs, Certification/Approval details, Product references. All these will help build the Buyers trust, confidence and involvement on the product resulting in sales.

Notes on Weight Discrepancy:

Kindly double check and ensure to update proper shipping box/package weight and dimensions of the product in the product settings page. The shipping box/package weight and dimensions that you provide in the product settings page are used for calculating actual shipping costs dynamically during checkout. Any discrepancy in weight or dimensions will incur additional shipping charges as calculated by our shipping partner post shipment and will be deducted from your settlement for future orders.

If you feel the shipping weight calculated by our shipping partner post shipment is not right, you have an option to raise a dispute. If you would like to raise a dispute, we request you to kindly send us sample photographs of similar shipping boxes/packages with products showing weight and dimensions within 5 days of receiving an intimation email from us. Look at the sample weight dispute photographs (sample1, sample2) to get an idea of what kind of photographs are required to submit a dispute. We will raise a dispute with our shipping partner using the photographs that you share with us within 5 days. If our shipping partner accepts your claim you will not be charged for the weight discrepancy, else the additional shipping charges will be deducted from your settlement for future orders.

The Consumer Protection Act , 2019, which came into force from July 20, 2020, has brought in a new regulatory framework for e-commerce in the country. The government has notified new rules and regulations for e-commerce companies under the Consumer Protection Act, 2019, making it mandatory to display the 'country of origin' on their products stating that any non-compliance will attract penal action under the Act.

References:

Provide as much details as possible. Use as much description, photographs, videos as possible. The more the better. It shows the importance you give to the product and care you show for the Buyers looking at your product.

Product photographs not only testify to the quality of your product, but also serve as windows into your brand. Your products are the face of your brand. Photographs makes the first impression on Buyers, creating a tipping point as to whether they will continue browsing and eventually make a purchase. Perhaps the biggest pain point of online shoppers is the lack of ability to see and touch products in person before purchasing them. Without the ability to pick them up and see products for themselves, Buyers rely on your product photographs to understand the quality of your brand. No matter how high quality your products are, no one will buy them if your photographs are low quality.

The first E-commerce website you visit features multiple high-quality images, detailed specifications, customer reviews, and even a video showing the shoes from multiple angles. The second website you visit features exactly one photo of the shoes, very little information about sizing and color options, and zero customer reviews. Which site are you more likely to purchase from? Obviously, the first one.

It is rather true that “A picture is worth a thousand words”. We cant’t insist much more on the importance of a good photograph of your product.

For any product photograph, it is important for the product to be the focal point. Using white background means you’re able to present your products with accurate photos from the quality to details with the least or no distractions. Using white background for all products ensures consistency.

Good quality photographs of the product in different angles, Photographs of FSSAI License on the product in case of food product, Photographs of certified Logos on the product, Photographs of the ingredients of the product. Video description, Ad or review of the product is a plus.

It will impact the sale of the product as it will be out of place and also create not so good impression on your brand and ours.

We would gladly assist you in setting up your store, help you in each of the step involved to start with and also will provide you all required guidance and information so that you can confidently handle your store on your own going forward. Why wait, reach out to us for any help!

Commission Fee is the Fee collected on every Order for services provided by VeganMall.

Maintaining an online marketplace involves various pieces put together. Domain, Hosting, Website development and periodic maintenance, Marketing, Promotions, Providing Support are some of those visible pieces and each of these pieces come at an expense. Commission Fee is the main source of income for VeganMall to pay for these expenses and what is left makes our earning. After all, we are a running a business.

We are just starting out and having a simple Commission model makes life easy for us and for you. Based on the feedback and the way we progress ahead together this could change to benefit both of us.

Every sale on E-Commerce Marketplace involves two type of transactions.

The GST rates for services are decided by the Government of India and we have to adhere to the decided rates. The GST rate fixed for services can be found at http://cbic.gov.in/resources//htdocs-cbec/gst/services-booklet-03July2017.pdf

TCS is deducted under GST. It is the Tax Collected at Source (TCS) which is the tax payable by the Seller which he collects from the Buyer at the time of sale. TCS is collected by VeganMall as an E-Commerce Marketplace Operator from the consideration received by it on behalf of the supplier of goods which is you and paid to the government. You can claim ITC(Input Tax Credit) for the TCS collected by VeganMall and reduce your tax liability by that amount when paying GST to government.

Yes.

As per CBIC Notification No. 51/2018 – Central Tax dated 13 September 2018., the Central Government notified that the 1st day of October, 2018, as the date on which the provisions of section 52 of the CGST Act, 2017 shall come into force.

References:

1% ( 0.5% CGST + 0.5 % SGST for Intrastate supplies or 1% IGST for Interstate supplies)

As per CBIC Notification No. 52/2018 – Central Tax dated 20 September 2018., the Central Government notified that every electronic commerce operator, not being an agent, shall collect an amount calculated at a rate of half per cent. of the net value of intra-State taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the said operator.

As per Section 52 of the CGST Act, 2017 and Section 52 of the SGST Act, 2017, every electronic commerce operator (hereafter in this section referred to as the “operator”), not being an agent, shall collect an amount calculated at such rate not exceeding one per cent., as may be notified by the Government on the recommendations of the Council, of the net value of taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the operator.

As per Section 20 (xi) of IGST Act, 2017, the provisions of Central Goods and Services Tax Act relating to collection of tax at source; shall, mutatis mutandis, apply, so far as may be, in relation to integrated tax as they apply in relation to central tax as if they are enacted under this Act. Provided further that in the case of tax collected at source, the operator shall collect tax at such rate not exceeding two per cent, as may be notified on the recommendations of the Council, of the net value of taxable supplies.

References:

TDS is deducted under Income Tax (IT). It is the Tax Deducted at Source (TDS) under proposed section 194-O of the Income Tax Act, 1961

In the Finance Act 2020, the Government has introduced new rules in Section 194-O which provides a withholding of TDS by e-commerce operators for facilitating sale of goods and/or services of e-commerce participants through its marketplace. These rules are effective from October 1, 2020.

References:

1% of Gross Sale Value.

References:

Yes.

There is an exclusion for Individuals and Hindu Undivided Sellers (HUFs) where the gross sales of the product or service during the financial year is less than INR 500,000 and PAN or Aadhaar is provided. Further, only Indian resident sellers are covered in the TDS rules.

Shipping Options:

Self Shipping Only

Note: Shipping using VeganMall Shipping Partner has been discontinued from 1-Jan-2023

The Seller has to take care of both forward and return shipping for their orders.

By default, the Buyer pays for Shipping based on the Shipping Cost set by the Seller. If the Seller has enough margin they can provide discounted or free shipping to attract more Buyers.

The RTO(Return To Origin) shipping charges are to be paid by the Sellers.

If there is any issue with the product, the Reverse/Return shipping charges has to be paid by the Seller of the product. In case of change in decision by Buyer or if the fault is from the Buyer end, the Reverse/Return shipping charges will be charged to the Buyer. We constantly monitor the returned orders and take necessary actions to reduce the same. To safeguard from products getting returned, we request all sellers to update exact product description and ensure that all the information provided in the product page exactly matches with the the product delivered to Buyer.

Settlements are paid out instantly through Cashfree Marketplace Settlements on Delivery of the products to customers. If you are shipping through our Shipping partners, the delivery will be tracked automatically. If you are Self Shipping then you need to update the shipment tracking information for the order once you ship it so that the system can track its Delivery. If you fail to update the tracking information, it will never get tracked and hence the system will not be able to make the settlement.

Settlements are made by direct bank NEFT online transfer to the bank account mentioned in the Seller Store Dashboard Settings through Cashfree Marketplace Settlements

Contact us immediately within 3 days to resolve any discrepancies after which it will be difficult for us to handle if the discrepancy involves our billing or shipping partners who too have deadlines to report discrepancies.

The exact Settlement amount will be as per the calculations provided in our Fee Structure which you have agreed upon during registration. The Fee Structure can be found in the “Fee Structure” section in our Seller Information page.

Ideally No. In cases where there are discrepancies in the shipping weight or dimensions provided by you for your shipping, the difference of shipping will be charged to you as per the calculations made by our shipping partner. Any applicable RTO and Return/Reverse shipping charges will also be charged to you. These charges will be intimated to you and adjusted in the Settlement made.